Off-payroll working legislation will be rolled out to the remainder of the public sector and the private sector on the 6th of April 2021, when our clients will take the HMRC financial risk for ensuring the limited company contractors they engage have the correct IR35 employment status.

The UK economy has faced adverse effects due to the pandemic including a shrinking economy, much higher public spending, and inevitable lay-offs to name a few. With all of this going on, off-payroll working legislation is still set to be rolled into the private sector from April 2021. As a hiring organisation, you’ll probably have questions around the mechanism of this legislation, its risks, and how it may affect you.

What is ‘off-payroll’ working?

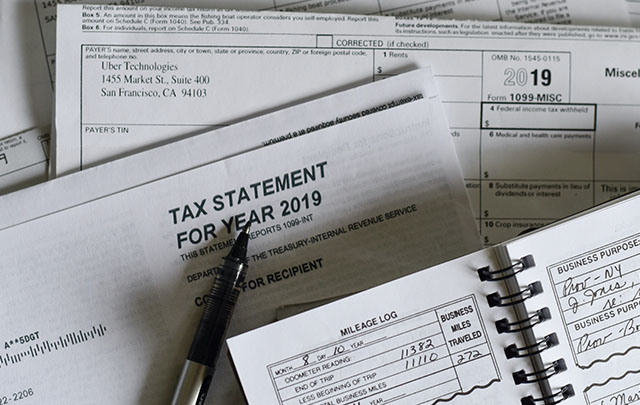

Firstly, it is important to understand what it means to be considered as “off-payroll working”. This applies to contractors that are operating via their own personal service companies, while providing services to a client. A report showed that during the year 2019, there were almost 5 million self-employed workers in the UK, many of which are contractors. HMRC believes that often these contractors are disguised employees hiding behind the status of “self-employed”.

Currently, it is the responsibility of your contractors to determine their own employment status by assessing their contract and working practises against what is known as the IR35 intermediaries legislation. An ‘outside IR35’ decision means the contractor pays significantly less tax. HMRC believes that the workers often do not do the assessments correctly. HMRC suggests that nine out of ten times, the ‘outside IR35’ decisions are incorrect.

To avoid this, the government is shifting the responsibility to the hirers/clients. This means that an end client will be responsible for determining employment status and passing that decision down the supply chain so the correct payment method and deductions can be made.

With less than five months to go until IR35 reform, the onus is on hiring organisations and their recruitment partners to prepare for the changes. Contrary to speculation, IR35 reform is manageable, but the work must start immediately.

What is changing and when?

The IR35 off-payroll working legislation was originally going to be implemented in April 2020, but due to the pandemic, it has been pushed to 6th April 2021. The government has passed the legislation and it is set to apply to the private sector in April 2021 as planned.

As a recruitment and employment business, we have a clear understanding of what it means and how the rules apply. At MRG, we provide tailored services and full assistance to help client organisations with everything related to the off-payroll working legislation and what it means for contractors to be inside or outside IR35, including providing engagement solutions for contractors so future payments to them are compliant with the legislation.

Who do the changes affect?

According to HMRC, the off-payroll working legislation does not affect small companies. To be smart and efficient in its decision, HMRC set the following criteria for a company to qualify as a “small company”. You will need to fulfil at least two of these conditions to be exempt from off-payroll working:

- balance sheet total less than or equal to £5.1 million, or

- annual turnover less than or equal to £10.2 million, or

- less than or equal to 50 employees

If you are not designated a small company, from April 6th 2020, IR35 rules will apply to your organisation.

What are the impacts of these changes?

As the financial and reputational risk ultimately lies with the client organisation, hirers will need to review their current workforce and how contractors are engaged.

The experience we have gained working with the public sector to mitigate potential risk from IR35 makes MRG the ideal recruitment partner to support and guide contingent workforce strategies moving forward. We can help client organisations reach the correct determinations for current contracting workforce, and manage the status determination process and payrolling solutions if LTD contractors need to go through a PAYE service.